In today’s rapidly changing economic landscape, financial education has emerged as a vital tool for empowering individuals to navigate the complex world of personal finance. Within the Australian context, where financial stability and wellbeing are pressing concerns, the significance of financial education for employees cannot be overstated.

While organisations devote considerable attention to professional development and skills training, the importance of equipping employees with financial knowledge often goes unnoticed. This oversight can lead to challenges in managing personal finances, making sound investment decisions, and ultimately experiencing financial stress.

According to the ANZ Financial Wellbeing Survey in Australia, approximately 2.4 million Australians, equivalent to 13% of the respondents, reported an average financial wellbeing score of 19 out of 100, indicating significant struggles in managing their finances. This makes financial education all the more critical for employees in Australia.

As we explore why is financial education important for employees in Australia, we will uncover the benefits it brings to both individuals and organisations. By recognizing the need for financial education and its potential impact, we can pave the way for a more financially resilient workforce, addressing the inherent challenges employees face in their financial lives.

What Is Financial Education?

Financial education refers to acquiring knowledge and skills related to managing personal finances, making informed financial decisions, and understanding various aspects of the financial system. It encompasses various topics, including budgeting, saving, investing, borrowing, insurance, taxes, and retirement planning.

Financial education empowers individuals with the necessary tools and knowledge to make sound financial choices and improve their overall financial well-being. It equips people with the skills to understand and navigate complex financial concepts like interest rates, credit scores, investment options, and financial risks.

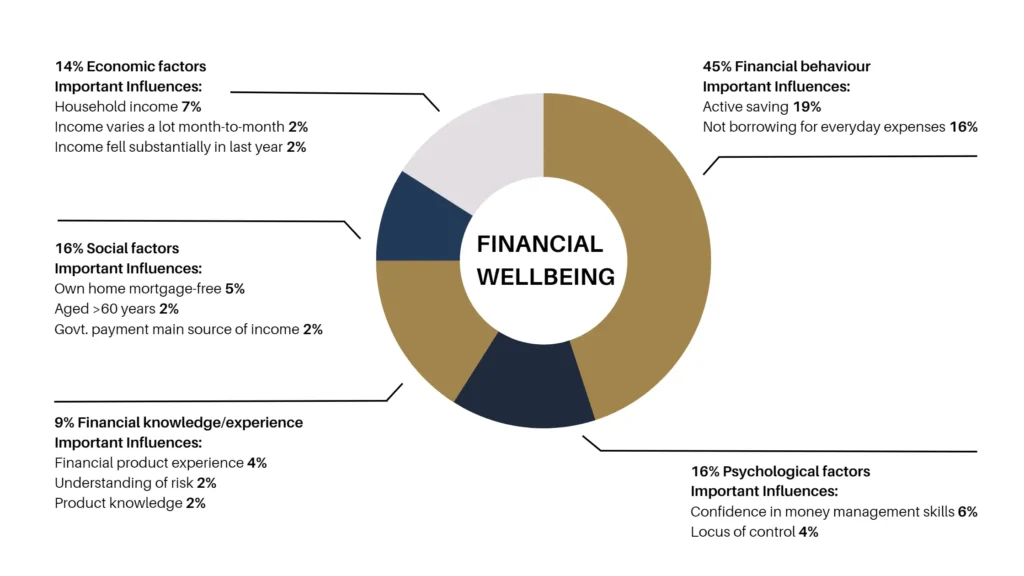

According to the Financial Wellbeing survey conducted by ANZ, the five domains of the Kempson Model explained the 69% financial wellbeing of the Australian respondents.

Thus, providing individuals with financial education can develop a better understanding of how to create and maintain a budget, manage debt effectively, save for future goals, evaluate investment opportunities, protect themselves from financial fraud, and plan for a secure retirement. It can also help individuals develop critical thinking and problem-solving skills to address financial challenges and make informed decisions that align with their goals.

What Are The Key Aspects Of Financial Education For Employees?

The key aspects of financial education for employees include:

- Budgeting and Money Management:

Employees should learn how to create and maintain a budget that aligns with their income, expenses, and financial goals. This includes tracking expenses, prioritising spending, managing debt, and establishing an emergency fund.

- Saving and Investing:

Financial education should cover the importance of saving money and the various options available for saving, such as regular savings accounts, certificates of deposit (CDs), and retirement accounts. It should also provide an understanding of basic investment concepts, risk management, and long-term wealth-building strategies.

- Debt Management:

Employees should learn about different types of debt, such as credit cards, loans, and mortgages, and how to manage them effectively. This includes understanding interest rates, repayment strategies, and debt consolidation options.

- Retirement Planning:

Employees should be educated about retirement planning, including the importance of starting early, the benefits of employer-sponsored retirement plans, and the concept of compound interest. They should also understand retirement investment options,

withdrawal rules, and strategies for maximising retirement savings.

- Tax Planning:

Financial education should cover the basics of personal income taxes, including understanding tax brackets, deductions, credits, and proper tax planning. Employees should be familiar with tax-advantaged accounts, such as Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs).

- Insurance and Risk Management:

Employees should learn about various types of insurance, including health insurance, life insurance, disability insurance, and property insurance. They should understand how insurance works, the importance of coverage, and how to evaluate and choose appropriate insurance policies.

- Financial Decision-Making:

Financial education should equip employees with the skills to make informed financial decisions. This includes evaluating financial products and services, understanding terms and conditions, comparing costs, and recognizing potential risks and benefits.

- Consumer Protection and Financial Fraud:

Employees should be educated about common financial scams, identity theft, and fraudulent practices. They should understand how to protect themselves from financial fraud and make safe and secure financial transactions.

- Financial Goal Setting:

Financial education should encourage employees to set short-term and long-term financial goals. This involves identifying priorities, creating actionable plans, and regularly reviewing and adjusting goals based on changing circumstances.

- Behavioural Finance:

Understanding behavioural finance helps employees recognize common biases and psychological factors influencing financial decision-making. It encourages self-awareness and promotes mindful financial choices. By addressing these key aspects, financial education empowers employees to take control of their finances, make informed decisions, and work towards achieving their financial goals.

How Can Financial Education Be Provided To Employees?

There are several ways to provide financial education to employees. Here are some standard methods:

- Workshops and Seminars:

Conducting in-person or virtual workshops and seminars effectively provide financial education to employees. Experts or financial professionals can be invited to deliver presentations on budgeting, saving, investing, retirement planning, and debt management. These sessions can include interactive discussions, Q&A sessions, and practical exercises to enhance learning.

- Online Courses and Webinars:

Online courses and webinars offer flexibility and convenience for employees to access financial education resources. Employers can provide access to reputable online platforms or create customised courses that cover various financial topics. These courses can include video lessons, interactive quizzes, and downloadable resources to support learning.

- One-on-One Financial Counselling:

Offering one-on-one financial counselling sessions with financial professionals or certified financial planners allows employees to receive personalised guidance and advice. These sessions can address financial concerns, provide tailored recommendations, and help employees create individualised financial plans.

- Financial Wellness Programs:

Implementing comprehensive financial wellness programs within the organisation can promote financial education. These programs can include a combination of educational resources, tools, and services to support employees’ financial well-being. For example, employers can provide access to online financial planning tools, budgeting apps, or financial literacy apps that offer educational content and interactive features.

- Employee Benefits Communication:

Incorporating financial education into employee benefits communication is an effective way to reach a broader audience. Employers can include financial literacy materials, tips, and resources in benefits handbooks, newsletters, intranet portals, and other internal communication channels. This ensures that employees receive regular reminders and updates about financial education opportunities.

- Lunch and Learn Sessions:

Organising informal lunch and learn sessions can create a relaxed and interactive environment for financial education. Employees can bring their lunch while participating in brief educational sessions on specific financial topics. Internal experts or external speakers can lead these sessions and encourage open discussions and sharing of experiences among employees.

- Financial Education Resources:

Employers can provide access to various financial education resources, such as books, articles, podcasts, and online videos. Curating a collection of recommended resources and making them available to employees encourages self-study and continuous learning.

- Partnerships with Financial Institutions and Nonprofits:

Collaborating with financial institutions, banks, credit unions, or nonprofit organisations specialising in financial education can provide additional resources and expertise. These partnerships can involve workshops, webinars, or guest speakers who can deliver educational sessions tailored to the organisation’s employees.

It’s essential to assess the needs and preferences of employees to determine the most suitable methods for financial education. A combination of different approaches can be adopted to cater to various learning styles and ensure maximum engagement and effectiveness.

Why Is Financial Education Important For Employees In Australia

Financial education is essential for employees in Australia for several reasons:

- Personal Financial Wellbeing: According to the ANZ Financial Wellbeing Survey in Australia, 22% of Australians had no savings. Employees can effectively manage their finances with the knowledge and skills gained through financial education. They can develop budgeting skills, understand the importance of saving, make informed decisions about borrowing and investing, and plan for their future financial goals. This leads to greater financial stability and reduces financial stress, allowing employees to focus more on their work and overall wellbeing.

- Workplace Productivity: Financial stress can significantly impact employee productivity and job performance. It can cause distractions, absenteeism, and reduced engagement, which affect the overall effectiveness of the workforce. The economic impact of financial stress on businesses in Australia is significant, resulting in an estimated loss of $66.8 billion. This loss stems from reduced employee focus, motivation, and productivity caused by financial distractions. By providing financial education, employers can help alleviate financial stress among employees, leading to improved focus, motivation, and productivity in the workplace.

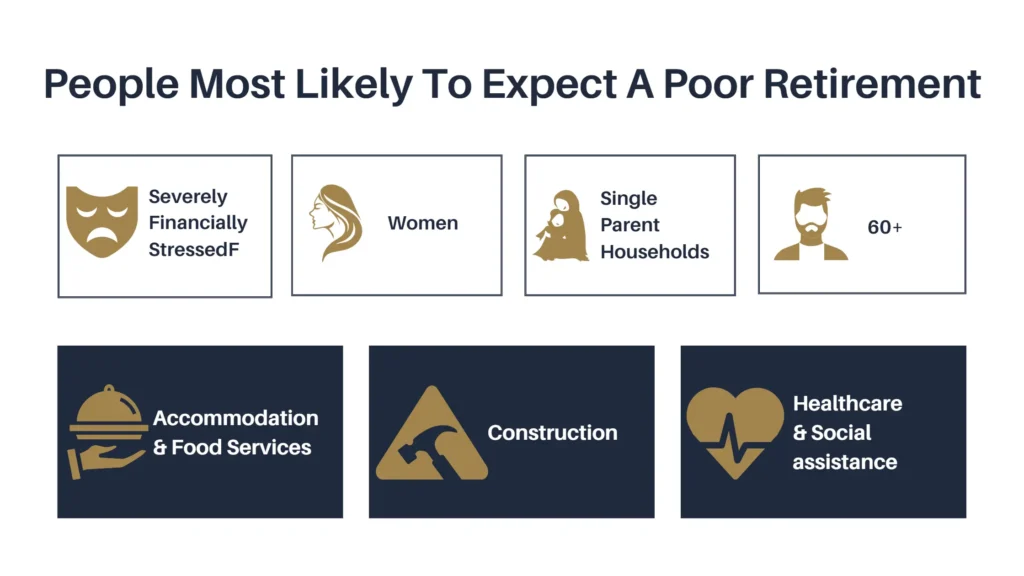

- Retirement Planning: Many employees in Australia may be unsure about their retirement plans and lack the necessary knowledge to make informed decisions about their retirement savings. 59% of older Australians (65+) are worried about their debt levels.

Financial education can help employees understand retirement planning options, such as superannuation and other investment vehicles. It enables employees to make informed choices about contributions, investment strategies, and long-term financial goals, ensuring a more secure retirement.

- Benefits Optimization: Employers in Australia typically offer various benefits, such as superannuation, health insurance, and employee stock options. However, employees may not fully understand how to maximise the benefits available to them. Financial education can help employees comprehend their benefits package, make informed decisions about contributions and coverage levels, and take advantage of available benefits, ultimately maximising the value of their employment compensation.

- Financial Wellness Programs: Many organisations in Australia are implementing financial wellness programs as part of their employee benefits package. These programs include financial education resources, tools, and services to support employees’ financial well-being. By offering financial education, employers demonstrate their commitment to their employees’ overall wellness, increasing job satisfaction, loyalty, and retention.

- Avoiding Financial Pitfalls: Financial education equips employees with the knowledge to recognize and avoid common financial pitfalls, such as excessive debt, predatory lending, scams, and poor investment choices. In Australia, where financial regulations and products can be complex, financial education is particularly important to help employees navigate the financial landscape and make informed decisions, protecting them from financial hardships and negative consequences.

Financial education for employees is important as it improves productivity, employee satisfaction, and overall organisational success. Additionally, financially educated employees can make better financial decisions, positively impacting their long-term financial well-being.

How Does Financial Education Benefit Employers/ Organisations?

Financial stress not only affects the employees but the employers as well.

Financial education of employees offers several benefits to employers in Australia:

- Increased Productivity: Financial education improves focus, motivation, and productivity by reducing financial distractions and stress among employees.

- Reduced Absenteeism: Providing financial education helps employees better manage their finances, reducing the need for time off due to financial stress and improving attendance rates.

- Enhanced Employee Satisfaction and Loyalty: Financial education demonstrates a commitment to employee well-being, leading to higher satisfaction, loyalty, and retention rates.

- Improved Financial Decision-Making: Financially educated employees make better financial decisions, benefiting their personal lives and work-related matters.

- Reduced Workplace Stress: Financial education reduces financial stress, creating a less stressful work environment and improving overall well-being.

- Competitive Advantage: Offering financial education and wellness programs attracts top talent, highlighting the organisation’s commitment to employee support.

- Risk Mitigation: Financially literate employees are less likely to engage in risky financial behaviours, reducing potential financial risks for the organisation.

In summary, financial education benefits employers in Australia by boosting productivity, reducing absenteeism, enhancing employee satisfaction and loyalty, improving financial decision-making, reducing workplace stress, providing a competitive advantage, and mitigating financial risks.

Parting thoughts

In conclusion, financial education holds paramount significance for employees in Australia, paving the way for empowerment and resilience in an ever-evolving economic landscape. Financial education transcends mere monetary matters by equipping individuals with the knowledge and skills to make informed decisions, manage debt, invest wisely, and plan for the future.

It catalyses personal growth, enhanced wellbeing, and greater economic stability, enabling employees to seize opportunities, navigate financial challenges, and build a prosperous future. Embracing the power of financial education empowers individuals, strengthens communities, and fuels a vibrant and resilient economy for all Australians.

Take control of your financial future with Estate App. Managing personal finances can be overwhelming, especially without proper education. That’s why we’re here to empower you with the knowledge and tools you need to succeed.

Discover the power of financial literacy at your fingertips. Estate App provides a seamless experience for learning and managing your finances, regardless of your background or previous education. Gain the confidence to make informed decisions and navigate the complexities of the real world.

Join the growing community of individuals taking charge of their financial wellbeing. Start your journey towards financial empowerment. Contact us today!