Australia’s economic landscape has witnessed significant transformations in recent years. Factors such as technological advancements, globalisation, and regulatory changes have created new opportunities and challenges for individuals and organisations. In this dynamic environment, organisations prioritising their employees’ financial wellness, gain a competitive edge.

According to the above Financial Wellness Index of 2018, 54% of Australian employees felt mildly to severely stressed financially. It is quite evident that focussing on financial wellness of employees is paramount.

In this blog, we aim to provide the ultimate guide to employee financial wellness, as organisations prioritising financial wellness can attract top talent, enhance employee retention rates, and strengthen their employer brand.

1. Understanding Employee Financial Wellness

Financial wellness refers to the state of an individual’s overall financial health, encompassing their ability to effectively manage their finances, make informed financial decisions, and achieve their financial goals. It goes beyond just having a stable income and includes aspects such as budgeting, savings, debt management, retirement planning, and financial literacy.

The Significance Of Financial Wellness In The Workplace

In 2018, 2.44 million Australians were financially stressed. This makes employee financial wellness of utmost importance in the workplace as it directly impacts their overall well-being, job satisfaction, and productivity. When employees are financially stressed, they may experience reduced concentration, increased absenteeism, and decreased engagement.

Conversely, when employees have a sense of financial security and confidence, they are more likely to be motivated, focused, and satisfied in their roles.

Impact Of Financial Stress On Australian Employees And Organisations

48% of Australia’s workforce is worried about their finances. Financial stress can have significant implications for both employees and organisations in Australia. It can lead to decreased job performance, increased workplace accidents, and higher turnover rates.

Financially stressed employees may also experience adverse effects on their mental and physical health, leading to increased healthcare costs for organisations. Addressing financial stress and promoting financial wellness can help mitigate these adverse effects and contribute to a positive work environment and improved organisational outcomes.

2. Assessing Employee Financial Needs

To effectively support employees’ financial wellness, organisations must assess their specific financial needs.

Conducting Employee Financial Surveys: To effectively address employee financial needs in Australia, it is crucial to understand their specific challenges and concerns. Conducting employee financial surveys provides valuable insights into their financial well-being and helps identify areas where support is needed. This should be done confidentially and by asking relevant questions.

Identifying Common Financial Challenges: Identifying employees’ common financial challenges helps organisations tailor their programs and initiatives to address these specific needs. Some prevalent financial challenges may include the following:

- High Cost of Living: 39% of Australian households live beyond their means. Explore the impact of housing, utilities, transportation, and healthcare expenses on employees’ financial well-being, considering the varying costs across different regions.

- Debt Management: Over the past 25 years, household debt has increased nearly twice as fast as the value of the household. Understand the types of debt employees commonly face, such as mortgages, student loans, credit card debt, and personal loans.

- Retirement Planning: 44% of employees don’t know how much they will have saved for retirement. Recognize the complexities of the Australian retirement system, including superannuation contributions, investment options, and the transition to retirement. Help employees maximise their retirement savings and plan for a secure future.

- Financial Literacy Gaps: Identify areas where employees may lack financial knowledge and understanding, such as managing investments, understanding tax implications, or navigating the complexities of government support programs.

Tailoring Programs to Address Australian Employee Demographics: Australia’s diverse workforce requires tailoring financial wellness programs to cater to different employee demographics. Consider the following when designing programs:

- Age Considerations: Recognize the different financial needs and goals of employees at various stages of their careers, such as early career professionals, mid-career employees, and those approaching retirement.

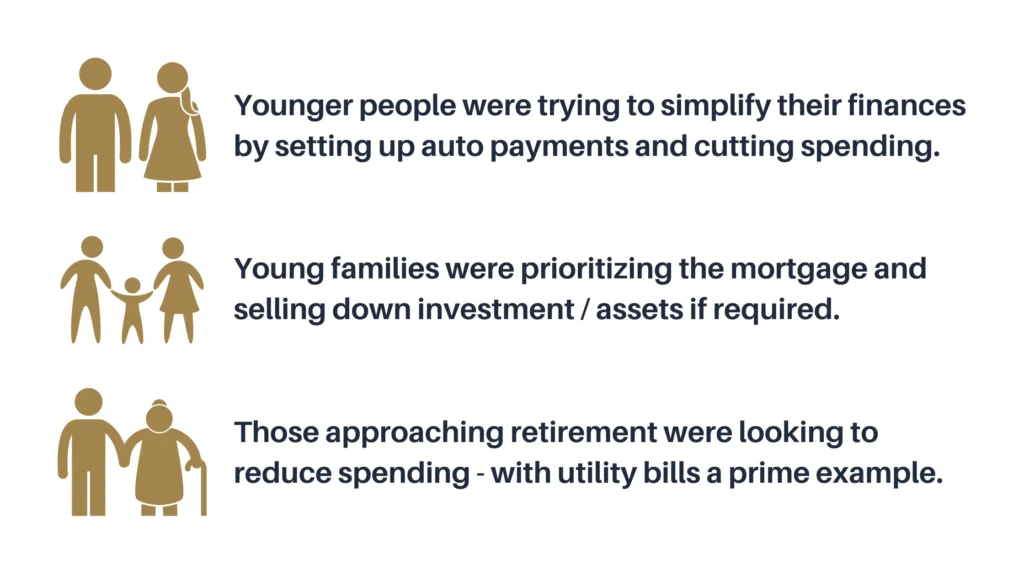

According to a study conducted by AMP, here is how people across different age groups try to cope with the changing economic climate of Australia:

- Cultural Diversity: Acknowledge the cultural backgrounds and financial practices that may influence employees’ financial behaviours and attitudes. Provide resources that respect and cater to diverse perspectives.

- Socioeconomic Factors: Understand the impact of socioeconomic factors on employees’ financial well-being. Customising programs to address varying income levels and financial circumstances ensures inclusivity and effectiveness.

- Industry-specific Considerations: Take into account the unique financial challenges faced by employees in specific industries, such as healthcare, mining, construction, or the gig economy.

Conducting employee financial wellness surveys enhance engagement, productivity, and overall wellbeing within the workforce.

3. Building A Financial Education Program

By prioritising financial literacy within your organisation, you can promote employee financial wellness.

Topics to Include in Financial Education for Employees

When designing a financial education program, it is essential to cover key topics that align with their financial needs. Some important areas to address include:

- Superannuation: Educate employees about the fundamentals of superannuation, including contributions, investment options, and strategies for maximising retirement savings.

- Budgeting and Money Management: Provide practical guidance on budgeting techniques, expense tracking, and effective money management strategies. Teach employees how to create realistic budgets, manage debt effectively, and build emergency funds.

- Taxation and Government Support Programs: Explain the basics of taxation in Australia, including income tax, deductions, and the use of tax-effective strategies. Familiarise employees with government support programs, such as the Age Pension, Family Tax Benefit, and childcare subsidies.

- Investment and Wealth Building: Introduce employees to investment principles, risk management strategies, and the various investment options available in Australia, such as shares, property, and managed funds.

- Financial Planning and Goal Setting: Guide employees to set financial goals, create personalised financial plans, and track progress towards their objectives.

By building a robust financial education program that focuses on financial literacy, organisations can empower their employees to make sound financial decisions, improve their financial well-being, and work towards long-term financial security.

4. Implementing Employee Benefit Plans

Implementing employee benefit programs in Australia is crucial for attracting and retaining top talent while promoting employees’ financial wellbeing. These include:

- Health Insurance and Healthcare Benefits:

According to the Australian Prudential Regulatory Authority (APRA), as at 31 December 2018, ONLY 44.6% of Australians were covered by private hospital cover. Ensure that employees have access to quality healthcare coverage, including options for private health insurance, coverage for medical expenses, and additional wellness programs to promote employee wellbeing.

- Retirement and Superannuation Plans:

Educate employees about superannuation contributions, investment options, and strategies for maximising retirement savings. Help them navigate the complexities of the Australian superannuation system and ensure they are prepared for a comfortable retirement.

- Salary Packaging and Novated Leases:

Consider offering salary packaging and novated leases as attractive benefits to employees in Australia. These programs allow employees to optimise their remuneration using pre-tax income for expenses such as car leases, mortgage repayments, or additional superannuation contributions.

- Employee Share Plans and Ownership Programs:

Engage and motivate employees by introducing employee share plans and ownership programs. These initiatives allow employees to become stakeholders in the company, fostering a sense of ownership, alignment, and loyalty. Ensure compliance with relevant regulatory requirements and provide guidance on how employees can participate and benefit from these programs.

- Education Support:

Demonstrate a commitment to lifelong learning by offering education support programs that align with the Australian education system. Familiarise employees with programs like HECS-HELP and FEE-HELP, which provide financial assistance for higher education and vocational courses. Encourage continuous professional development and consider offering tuition reimbursement or scholarships to support employees’ educational pursuits.

These benefits demonstrate a commitment to employees’ holistic needs and contribute to a positive and supportive work environment.

5. Establishing Employee Assistance Program (EAP)

Establishing Employee Assistance Programs (EAPs) in Australia is a valuable initiative for organisations aiming to support their employees’ well-being. These include:

- Providing Confidential Counseling Services:

In the Australian workplace, prioritising employees’ mental well-being is crucial. Organisations can offer employees a safe space to address personal and work-related challenges by providing confidential counselling services.

- Debt Management and Budgeting Assistance:

Offering debt management and budgeting assistance programs lead to employee financial wellness. Provide resources, workshops, and tools that help employees create adequate budgets, manage debt, and develop healthy financial habits. To provide targeted support, address the specific financial challenges employees face, such as mortgages, student loans, and credit card debt.

- Offering Retirement Planning Support:

With Australia’s complex retirement system, providing retirement planning support to employees is crucial. Offer personalised guidance to help employees make informed decisions about their retirement savings, ensuring they have the knowledge and tools necessary to plan for a financially secure future.

These programs contribute to employees’ overall well-being, addressing their mental and financial concerns while promoting a healthier and more engaged workforce.

6. Promoting Financial Wellbeing Through Incentives

Promoting financial wellbeing through incentives is a powerful strategy for organisations seeking to enhance their employees’ financial health. Here are a few strategies:

- Financial Wellness Incentives and Rewards:

Consider implementing incentives such as cash bonuses, gift cards, or additional time off to encourage employees to engage in activities that promote financial wellness, such as attending financial education sessions, achieving savings targets, or participating in retirement planning programs.

- Encouraging Employee Savings and Investments:

Consider partnerships with financial institutions to offer special savings accounts or investment options with tax benefits or higher interest rates. By promoting a savings culture and providing incentives, organisations can empower employees to build emergency funds, save for significant life events, and invest in their future.

- Matching Contributions and Bonuses:

Consider implementing matching contributions to superannuation accounts, where employers match a portion of employees’ contributions.

This encourages employees to maximise their retirement savings and take advantage of the benefits of the Australian superannuation system. Additionally, provide performance-based bonuses for achieving financial goals, such as debt reduction or meeting savings targets.

These initiatives not only benefit employees individually but also contribute to a financially resilient and engaged workforce.

Creating A Supportive Work Environment

Creating a supportive work environment fosters employee wellbeing and promotes financial wellness in Australia. This includes:

Cultivating a Culture of Open Communication in the Workplace:

- Encourage open and transparent communication about financial matters, providing employees a safe space to discuss their concerns and seek guidance.

- Establish regular channels, such as town hall meetings, surveys, or suggestion boxes, to gather employee feedback and suggestions on improving financial wellness initiatives.

Fostering Financial Wellness Advocates:

- Encourage employees to advocate for financial wellness within the organisation by providing training and resources.

- Establish employee resource groups or committees focused on financial wellbeing, empowering employees to share knowledge, experiences, and best practices.

- Recognize and celebrate the efforts of employees who actively promote financial wellness among their peers.

Flexible Work Arrangements and Leave Policies:

- Implement flexible work arrangements, such as remote work options or flexible hours, to accommodate employees’ personal and financial responsibilities.

- Provide generous leave policies that include personal, parental, or sabbatical opportunities, allowing employees to address their financial needs or pursue personal development without sacrificing their employment stability.

These initiatives contribute to a positive employee experience, increased productivity, and enhanced overall satisfaction, ultimately leading to a more engaged and resilient workforce.

Evaluating And Measuring Success

Evaluating and measuring the success of financial wellness initiatives is essential for organisations to ensure their effectiveness and make necessary adjustments for continuous improvement. This includes:

Tracking Employee Engagement and Satisfaction:

- Regularly assess employee engagement and satisfaction through surveys, feedback sessions, or focus groups.

- Use the collected data to identify areas for improvement, address concerns, and ensure ongoing employee engagement with the financial wellness initiatives.

Measuring the Impact on Business Performance:

- Evaluate the impact of financial wellness programs on key business metrics such as productivity, retention rates, and absenteeism.

- Collect and analyse data to determine financial wellness initiatives’ return on investment (ROI), highlighting the business value they bring to the organisation.

Adjusting Strategies for Continuous Improvement:

- Continuously monitor and evaluate the effectiveness of financial wellness programs, considering employee feedback and emerging trends.

- Use the gathered insights to refine and enhance the existing strategies, ensuring they remain relevant and aligned with employees’ evolving needs.

The evaluation process allows organisations to identify areas of strength and areas for growth, enabling them to optimise the support provided to employees and achieve long-term success in promoting financial well-being.

Elevate Employee Financial Wellness Through Estate App

Promoting financial wellness among employees is a responsible approach for employers. It demonstrates a commitment to their employees’ overall well-being, recognizing that financial stress can harm both personal and professional aspects of their lives.

Organisations can empower employees to achieve financial security and success by implementing employee financial wellness programs. These initiatives not only address the immediate financial needs of employees but also contribute to their long-term wellbeing. By fostering financial health, organisations can create a positive work environment where employees feel supported, motivated, and valued.

By prioritising employee financial wellness, organisations can build a culture of support, enhance employee engagement and satisfaction, and ultimately drive the success of both the employees and the organisation.

Take control of your financial future with Estate App. Managing personal finances can be overwhelming, especially without proper education. That’s why we’re here to empower you with the knowledge and tools you need to succeed.

Discover the power of financial literacy at your fingertips. Estate App provides a seamless experience for learning and managing your finances, regardless of your background or previous education. Gain the confidence to make informed decisions and navigate the complexities of the real world.

Join the growing community of individuals taking charge of their financial wellbeing. Start your journey towards financial empowerment. Contact us today!