Corporate Team Challenge

7, 10 or 21 Day Financial Wellbeing Challenge

Support Financial Wellness with a Corporate Team Challenge

Are you looking for a way to support your employees’ financial wellness and unlock their potential? Consider implementing a Corporate Team Challenge focused on personal finance. This win-win initiative not only benefits your company but also helps your employees conquer personal financial stress and gain essential skills for a brighter financial future. With over 50% of Australians experiencing money-related stress, financial health is a universally important aspect of employee well-being. By offering a 10-day or 21-day Financial Challenge, you can engage your team, improve productivity, boost morale, and reduce personal financial stress.

Corporate Team Challenge inclusions

7, 10 or 21 Day Financial Wellbeing Challenge includes:

- 3 months Estate Web App access

- Daily micro-video and audio learning courses

- Complete Financial Literacy Education Course

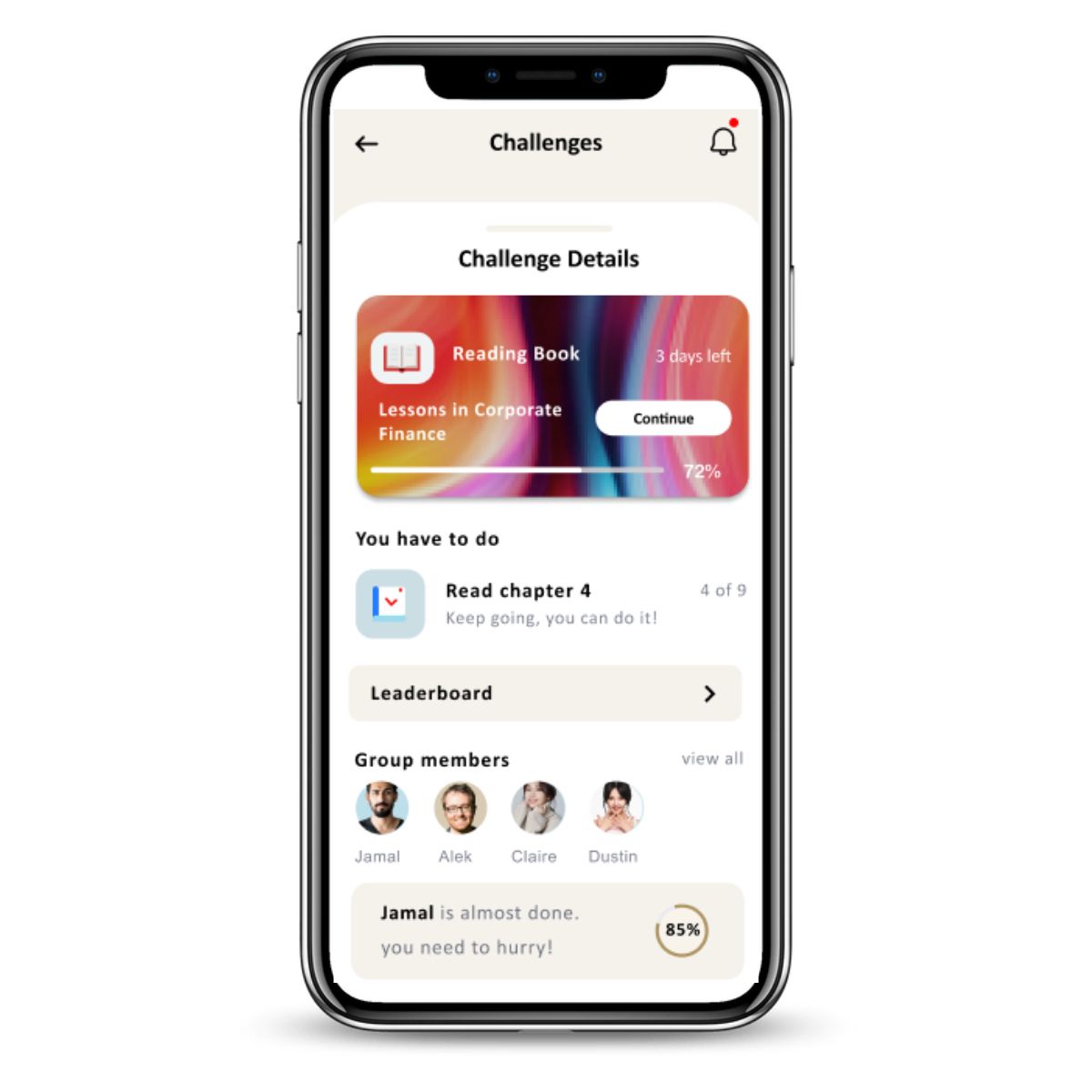

- Learning Quizzes, Points, Leaderboard, Prizes

- Connect with a like-minded community and message members

- Exclusive online forums

- Live Group Financial Coaching Sessions with senior, licensed financial professionals

SESSION ONE

Assessment of debts, income, living costs. Clients can see at a glance their actual financial situation. Homework: cashflow spreadsheet

SESSION TWO

Key short term cashflow strategies explored and initiate actions. Next pay is planned against expenses for up and coming pay period.

SESSION THREE

Long Term wealth creation and wealth protection strategies explored.

The Financial Coaching Process

Step by step financial coaching process:

We follow a very successful step by step process that allows each employee to:

- Fully understand their own financial situation.

- Comprehend the options that are available when in financial distress. Understand short term strategies to improve cashflow

- Long term wealth creation strategies

- Decide an appropriate course of action.

- Implement that action to create the change in their circumstances & follow up

Session 1: Initial assessment

- This appointment is aimed at preparing a preliminary spreadsheet for the employee to understand their current cashflow and financial situation.

- It will provide the employee with a concise list of debts, income & living costs.

- Immediate options available to them to improve cashflow are presented to the individual employee at this time.

- Outcome: The employee can see at a glance their actual financial situation and start to understand the direction necessary to take to improve their day to day financial situation

Session 2: Cashflow Strategies

- Employees are provided with information on the range of options available when a person experiences financial distress.

- Appropriate solutions for differing personal situations to improve cashflow.

- Employees are stepped through the method of ‘pay planning’.

- How to plan income against their expenses for the upcoming pay period and to ‘prepay’ bills where possible to create ‘consistency’ in cashflow.

Session 3: Long Term Wealth

- This session is aimed at employees understanding the key long-term wealth.

- Employees learn about how much money is required for retirement.

- Employees learn about risks in reaching retirement savings goals.

- Employees are provided with a checklist of key items to investigate to initiate long term wealth creation.

- Employees gain understanding of their financial situation and key changes needed to improve short term cashflow and obtain long-term financial security.

What you will learn over 21 Days

We follow a very successful step-by-step process that allows each employee to learn about essential financial literacy topics, including:

Manage your money:

- Financial Counselling

- Urgent help with money

- Save for an emergency fund

- Problems paying your bills

Debt Reduction:

- Get debt under control

- Pay off your mortgage faster

- Debt consolidation

Plan for your Future:

- Saving

- Group your Super

- Develop and investing plan

- What is financial advice?

- Managing Risk

Grow your wealth:

- Buying a house

- Developing an investing plan

- Choosing investments

- Diversification

- Investing and tax

- Borrowing to invest

- Keeping track of your investments

- ESG investing

Choosing Investments:

- Types of investments and returns

- How to choose your investments

- Decide how to invest

Shares:

- How to invest in shares

- How to research and invest in shares

- How to buy and sell shares

- Keeping track of shares

- Employee share schemes

Managed Funds and ETFs:

- Golden rules for investing in managed funds

- Choosing a managed fund

- Exchange traded ETS’s

- Hedge Funds

- Listed Investment Companies

- Peer to Peer Lending

Women and Wealth:

- Lifetime earnings

- Partner contributions

- Women and investing

- Effective retirement planning

Tools and Resources:

- Budget Planner

- Financial Counselling

- Superannuation Calculator

- Unclaimed Money