Group Financial Coaching

A skilled financial coach can help you uncover your financial goals, create a plan, and provide the support you need to stay on track, building your confidence to take control of your money

Why Financial Coaching?

Did you know that almost half of Australians experience financial stress? If you’re feeling the pressure, our short program is here to help. Our solution focused approach provides practical information to help you build cashflow and in the short and long term.

Our three-session model follows a step-by-step process that empowers you to fully understand your personal financial situation, comprehend available options, decide on an appropriate course of action, and implement positive change in your personal financial circumstances. Let us help you take control of your personal finances and reduce your financial stress today.

PRICING

-

Group Coaching: Team based

-

Delivery: Virtual

-

Length: 3 hours

-

Price: $4,500+ GST

-

Recommended class size is 12 participants

Online Booking

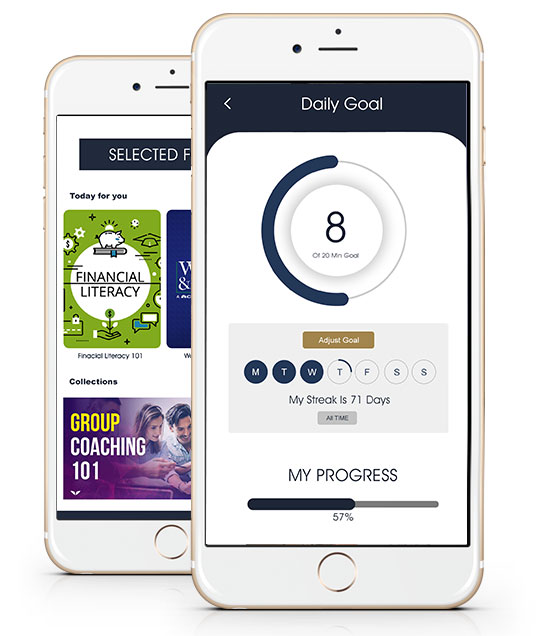

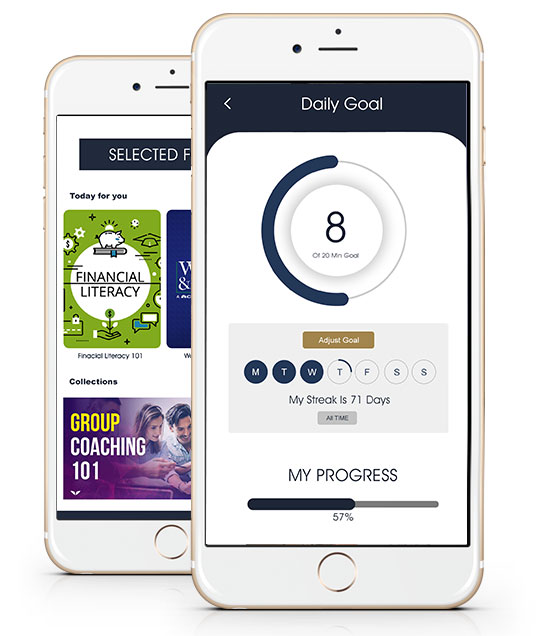

Book a 30 minute or 1 hour appointment with a compliant financial coach within Estate App to support you on your personal financial journey. Estate App’s audio learning challenges will compliment your finanical coaching experience and ensure that in between and following your personal coaching sessions your learning continues.

SESSION ONE

Assessment of debts, income, living costs. Clients can see at a glance their actual financial situation. Homework: cashflow spreadsheet

SESSION TWO

Key short term cashflow strategies explored and initiate actions. Next pay is planned against expenses for up and coming pay period.

SESSION THREE

Long Term wealth creation and wealth protection strategies explored.

The Financial Coaching Process

Step by step: Coaching Process

We follow a very successful step by step process that allows each client to:

-

We follow a very successful step by step process that allows each client to:

-

Comprehend the options that are available when in financial distress.

-

Understand short term strategies to improve cashflow

-

Long term wealth creation strategies

-

Decide an appropriate course of action.

-

Implement that action to create the change in their circumstances & follow up

Session 1: Initial Assessment

-

This appointment is aimed at preparing a preliminary spreadsheet for the client to understand their current cashflow and financial situation.

-

It will provide the client with a concise list of debts, income & living costs. Immediate options available to them to improve cashflow are presented to the client at this time.

-

Outcome: The client can see at a glance their actual financial situation and start to understand the direction necessary to take to improve their day to day financial situation.

Session 2: Short term cashflow strategies

-

Clients are provided with information on the range of options available when a person experiences financial distress

-

Appropriate solutions for differing personal situations to improve cashflow

-

Clients are stepped through the method of ‘pay planning’.

-

How to plan income against their expenses for the upcoming pay period and to ‘prepay’ bills where possible to create ‘consistency’ in cashflow

Session 3: Long term wealth creation

-

This session is aimed at clients understanding the key long-term wealth.

-

Clients learn about how much money is required for retirement.

-

Clients learn about risks in reaching retirement savings goals.

-

Clients are provided with a checklist of key items to investigate to initiate long term wealth creation

-

Client gains understanding of their financial situation and key changes needed to improve short term cashflow and obtain long-term financial security

Why Choose Estate App for Financial Coaching?

- Expertise: Benefit from the expertise of our highly skilled and experienced financial coaches.

- Convenience: Enjoy the convenience of online booking, allowing you to schedule coaching sessions at your convenience.

- Comprehensive Approach: Our coaching program follows a step-by-step process, addressing short-term and long-term financial goals.

- Personalised Guidance: Receive personalised guidance tailored to your unique financial situation and goals.

- Continuous Learning: Access Estate App’s audio learning challenges supplement and enhance your coaching experience.

Frequently asked questions (FAQ)

Financial coaching is a collaborative process where a trained professional provides guidance and support to help individuals or families improve their financial well-being. It focuses on setting and achieving financial goals, managing money effectively, and making informed financial decisions.

Financial coaching can benefit you in various ways. It can help you gain clarity and control over your finances, develop effective budgeting and saving strategies, reduce debt and retirement plans, and achieve your financial goals. It provides personalised guidance and accountability to help you make positive changes and build a secure financial future.

Yes, financial coaching is suitable for individuals from all walks of life. Whether you’re just starting your financial journey, struggling with debt, or aiming to maximise your wealth, financial coaching can provide valuable insights, strategies, and support to help you make informed financial decisions and achieve your goals.

While financial planning focuses on creating a roadmap for your goals and often involves investment strategies, financial coaching takes a more holistic approach. It focuses on behaviour change, building financial skills, and addressing mindset and habits to achieve long-term financial success. On the other hand, financial counselling typically involves assisting individuals in overcoming specific financial challenges or crises.

Finding the right financial coach involves considering their qualifications, experience, approach, and areas of specialisation. Look for certified financial coaches, read client testimonials or reviews, and consider scheduling a consultation or free trial session to gauge their compatibility with your needs and goals.