You’re sitting at your kitchen table, surrounded by a heap of bills, bank statements, and tax forms. The numbers seem to dance before your eyes – savings, expenses, investments, debts. It’s like an unfathomable puzzle; no matter how hard you try, you can’t seem to understand it all.

It’s not just about paying bills on time or saving for the holidays – it’s about planning for the future, securing your retirement, and making your money work for you.

In fact, it’s not just you. There are millions out there feeling overwhelmed, underprepared, and anxious when it comes to their finances. No matter how much they earn, they’re constantly caught in a loop of financial confusion and uncertainty.

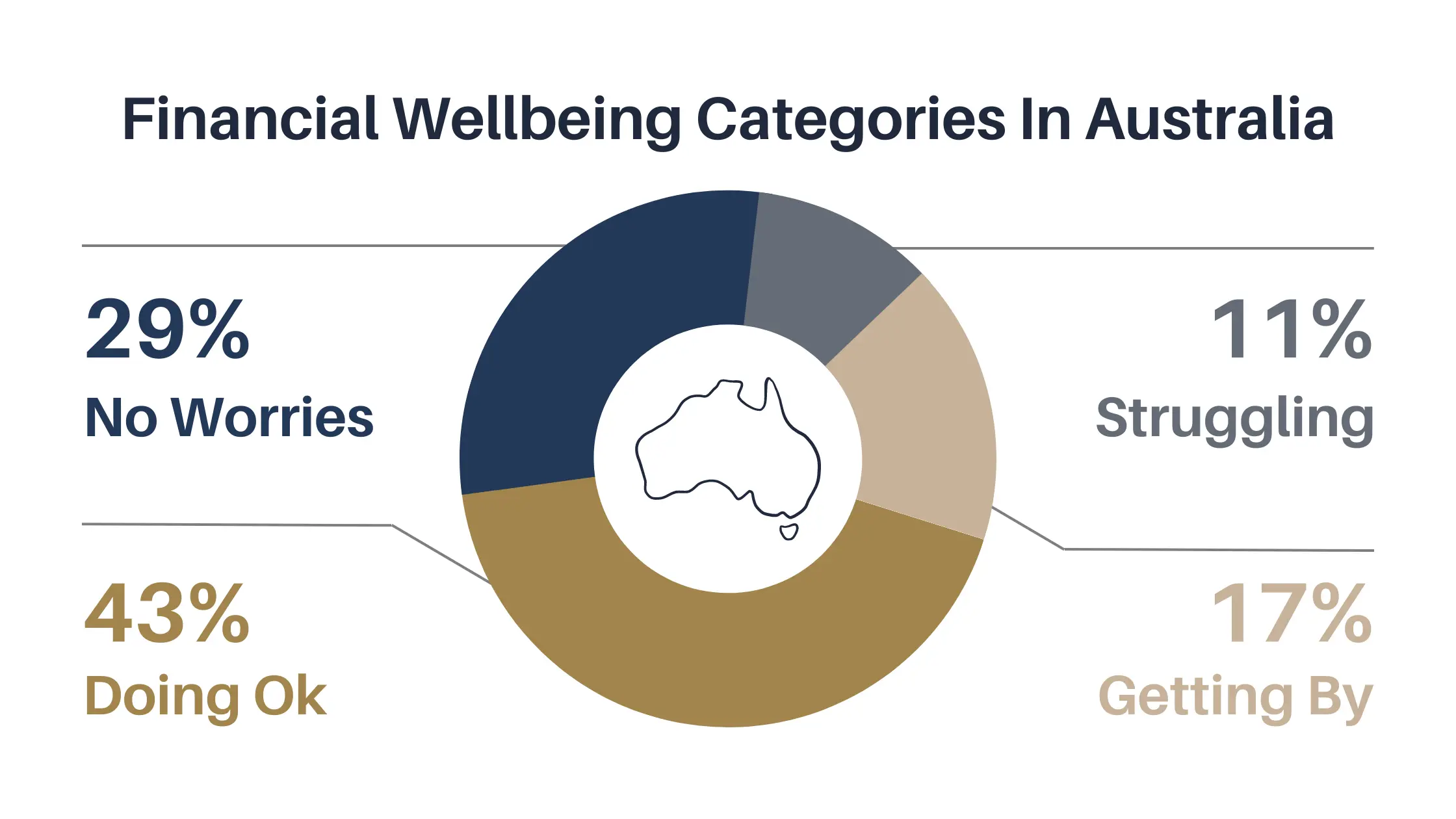

The 2021 ANZ Financial Wellbeing Survey – Australia revealed that an alarming 71% of respondents were grappling with some form of financial struggle. Here’s a closer look at the breakdown:

Can you understand the gravity of the situation?

That’s where right financial coaching comes in to bridge the gap!

It’s like having a personal trainer, but instead of building physical strength or losing weight, you’re working towards financial health and independence. A financial coach doesn’t just help you understand the numbers; they help you build a relationship with your money. They guide you through your financial journey, enabling you to make informed decisions, steer clear of common pitfalls, and ultimately achieve your financial goals.

Navigating your finances doesn’t have to be a lonely, daunting endeavour. With the right financial coaching, you can take charge of your money and build a financially secure future.

Let’s explore how to find the right financial coach for you.

What Can You Gain From Financial Coaching?

Right financial coaching offers a myriad of advantages that can positively impact your financial wellbeing and lead to a more secure and prosperous future. Here are the major benefits you can expect from financial coaching:

- Reduced Stress

Managing money can be overwhelming and stressful, especially when facing financial challenges. A financial coach provides guidance and support, helping you navigate through difficult situations and reduce financial stress.

- Long-Term Financial Stability

Right Financial coaching focuses on creating sustainable financial habits and strategies that lead to long-term stability. By setting clear goals and following a well-structured plan, you can build a strong foundation for your financial future.

- Better Decision Making

A financial coach empowers you with knowledge and understanding of financial concepts. This newfound awareness enhances your ability to make informed decisions about investments, saving, spending, and debt management.

- Improved Financial Behaviour

Right financial coaching goes beyond short-term fixes. Coaches work with you to develop positive financial behaviours that become ingrained in your routine. This leads to better money management and increased financial confidence.

Why Do You Need the Right Financial Coaching?

Financial coaching is not just another passing trend; it is a vital resource that can significantly improve your financial wellbeing and pave the way to a more secure future. Here’s why you need right financial coaching:

- Clarifying Your Financial Goals

Financial coaching helps you define clear and achievable financial goals. Whether you want to save for a down payment on a house, pay off debt, or plan for retirement, a coach can guide you in setting realistic and measurable objectives.

- Personalised Guidance

A financial coach provides personalised guidance tailored to your unique circumstances. They assess your financial situation, understand your goals, and create a customised plan to help you make the most of your money.

- Accountability and Motivation

Staying on track with your financial goals can be challenging. A financial coach acts as an accountability partner, keeping you motivated and focused on your objectives. They celebrate your successes and provide support during challenging times.

- Educating and Empowering You

Financial coaching is not just about telling you what to do. Coaches educate you on financial concepts and strategies, empowering you to make informed decisions and take control of your financial future.

- Demystifying Complex Financial Concepts

The world of finance can be overwhelming with its jargon and complexities. A financial coach breaks down complex concepts into simple terms, ensuring you understand the ins and outs of managing your money.

- Overcoming Financial Challenges

Household spending in Australia increased by 3.3% – and, financial coaches can help you tackle common challenges like budgeting, debt management, and investment decisions. They provide practical solutions and strategies to navigate through difficult financial situations.

- Building Financial Confidence

As you gain knowledge and see progress towards your goals, your financial confidence grows. A financial coach empowers you to make financial choices with confidence and peace of mind.

- Avoiding Costly Mistakes

Making uninformed financial decisions can lead to costly mistakes. A financial coach helps you avoid these pitfalls and ensures your money is used wisely.

- Creating Sustainable Habits

Right financial coaching focuses on creating long-lasting habits and behaviours that support your financial goals. These habits form the foundation of a stable financial future.

- Support during Life Transitions

Life is full of transitions – marriage, parenthood, career changes, or retirement. A financial coach guides you during these pivotal moments, ensuring your financial plan adapts to your changing circumstances.

Selecting The Right Financial Coach: Critical Factors

When choosing a financial coach, several important factors should be considered to ensure the best fit for your needs and goals. Here are key things to consider:

1. Your Financial Goals

- Clarify your financial objectives and what you want to achieve through coaching.

- Ensure the coach’s expertise aligns with your specific goals, whether it’s debt reduction, retirement planning, savings or budgeting.

2. Certifications and Expertise

- Look for a coach with relevant certifications and qualifications. These are essential indicators of their ability to provide sound financial guidance.

3. The Coaching Approach

- Understand the coach’s coaching style and approach.

- Choose a coach whose approach complements your financial needs.

4. Program Duration and Structure

- Inquire about the duration and structure of the coaching program.

- Understand the frequency and length of coaching sessions, as well as any additional resources or materials provided.

5. Cost

- Consider the cost of the right financial coaching program and whether it fits within your budget.

- While seeking affordable options is essential, prioritise the value and expertise offered by the coach over the price.

6. Coach’s Testimonials and Reviews

- Read testimonials and reviews from previous clients to gauge the coach’s effectiveness and client satisfaction.

- Positive feedback from others can provide valuable insights into their coaching style and results.

7. Coach’s Personality and Communication Style

- A strong coach-client relationship is built on trust and open communication.

- Choose a coach whose personality and communication style resonate with you, making you feel comfortable discussing your financial matters.

8. Support and Resources

- Inquire about the level of support provided outside coaching sessions.

- A good coach offers ongoing assistance and resources, such as tools, worksheets, or educational materials, to help you implement your financial plan.

9. Post-Program Follow Up

- Check if the coach provides post-program follow-up or continued support.

- Regular check-ins and follow-up sessions can ensure you stay on track with your financial goals even after the coaching program ends.

Questions to Ask Before Hiring A Financial Coach

Before hiring a financial coach, it’s essential to ask the right questions to ensure they are the perfect fit for your needs and goals. Here are some key questions to consider:

1. “What Are Your Credentials and Experience?”

Ask about their qualifications and if they’ve worked with clients with similar goals.

2. “What Services Do You Provide?”

Ensure their services match your specific needs.

3. “How Do You Charge for Your Services?”

Discuss their fee structure, whether it’s an hourly rate, a flat fee, or commission-based.

4. “Can You Provide References or Testimonials?”

Requesting references gives insights into the coach’s effectiveness.

5. “What is Your Right Financial Coaching Philosophy?”

The coach’s approach should align with your values and learning style.

6. “How Will You Help Me Reach My Financial Goals?”

Ask about their strategy to help you meet your objectives.

7. “How Do You Handle Conflicts of Interest?”

Ensure their advice is objective, especially if they’re affiliated with financial institutions.

8. “Can You Share Some Success Stories?”

Knowing their successful track record can boost your confidence in their abilities.

9. “How Will You Measure Progress and Success?”

Clear benchmarks will help you stay motivated.

10. “What is the Frequency and Format of Coaching Sessions?”

Know the frequency, duration, and medium of coaching sessions.

Remember, asking these questions will help you make an informed decision and find the right financial coach who can provide the guidance and support you need to achieve your financial dreams.

How to Make the Final Decision?

As you reach the final stretch of selecting a financial coach, remember these key points:

1. Consider the coach’s qualifications and tactics

- Consider the coach’s credentials, experience, and communication skills.

- Look for someone who aligns with your specific financial needs and goals.

2. Trust your instincts

- Choose a coach with whom you feel comfortable and confident discussing your financial matters.

- Make sure he/she listens, respects your values, and prioritises your best interests.

3. Make adjustments (if necessary)

- Remember that finding the right financial coach is an ongoing process.

- Be open to making adjustments if needed.

It’s okay to switch coaches if you feel it’s necessary for your financial journey.

4. Focus on coach-client relationship

- Keep in mind that building a successful coach-client relationship takes time.

- Trust and rapport are vital – give yourself and the coach a chance to cultivate a strong working dynamic.

5. Stick to your commitment

- Stay committed to your financial goals and actively participate in the right financial coaching process.

- Your coach is there to guide and support you, but success ultimately depends on your dedication and willingness to take action.

Your financial success depends on this crucial decision. So, take your time, and weigh your options carefully!

Take Charge Of Your Finances With Estate!

A financial coach’s approach and philosophy need to align with your financial values and objectives.

They should understand your financial aspirations, risk tolerance, and long-term goals.

When your coach shares your mindset and values, it creates a solid foundation for collaboration and decision-making that is in line with your financial principles.

Now you know what difference a financial coach can make in your financial journey – right?

With the right financial coach as your guide, you’ll be able to face financial challenges, make smarter choices, and sail towards a stable financial future.

Remember, choosing a financial coach is an investment in yourself and your future. Take time to explore your options, ask questions, and picture the bright financial future that awaits you.

So, don’t wait any longer. Take action and start your journey with a qualified financial coach from Estate today! Join our community and start your journey towards financial empowerment. Contact us today!