Personal Financial Coaching

Enjoy life, free from financial stress. Gain control, build a prosperous future.

- Create savings

- Reduce debt

- Plan for a better financial future

Personal Financial Coaching: Empowerment, Clarity, and Stress-Free Money Management

Discover the power of Personal Financial Coaching with Estate. We’re here to help you take control of your finances, reduce stress, and welcome a prosperous future.

Don’t let financial stress control your life! With our Personal Financial Coaching, we offer a solution-focused approach to secure your financial well-being.

Your Journey With Estate's Personal Financial Coaching

With just three sessions, you can master practical techniques to improve your cash flow and secure your future. Embrace the freedom and positive change that comes with effective money management.

Online Booking

Kickstart your financial success with Estate’s simple online booking. Schedule a brief session with our certified coach and immerse yourself in our tailored coaching and enriching audio-learning challenges.

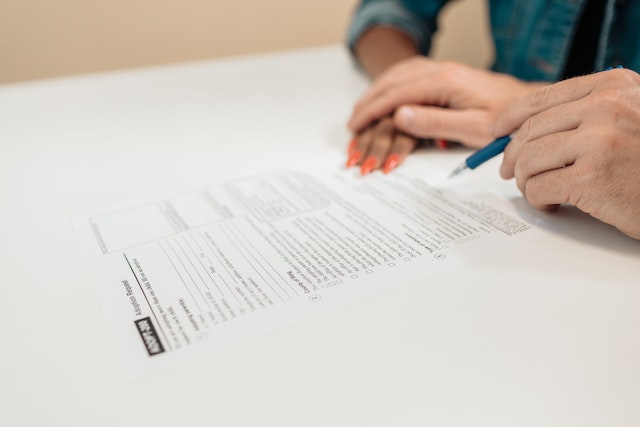

Initial Assessment

We quickly evaluate your financial status, covering your debts, income, and living costs. We provide a customised cash flow spreadsheet to help you manage your finances effectively.

Cash Flow Strategies

The second session focuses on short-term strategies to enhance your cash flow. Together, we strategize your upcoming expenses for immediate financial stability.

Wealth Creation

In the final session, we delve into long-term wealth creation and protection strategies, preparing you for a secure financial future.

Our Personal Financial Coaching Process

Comprehend

We understand all available options to tackle financial distress effectively.

Learn

We discover impactful short-term strategies to enhance your cash flow

Explore

We investigate long-term wealth creation strategies for a secure future.

Decide

We help you make informed decisions on the most suitable action for your financial well-being.

Implement

Take action and implement your plan, driving positive change in your financial status

Support

Receive continuous follow-up support to ensure sustained progress on your financial journey.

Why Choose Estate For Personal Financial Coaching?

Expertise

Benefit from the expertise of our highly skilled and experienced financial coaches.

Convenience

Enjoy the convenience of online booking, allowing you to schedule coaching sessions at your convenience

Comprehensive Approach

Our coaching program follows a step-by-step process, addressing short-term and long-term financial goals.

Personalised Guidance

Receive personalised guidance tailored to your unique financial situation and goals.

Continuous Learning

Access Estate App to supplement and enhance your coaching experience.

Build A Better Relationship With Your Money

Whether you’re burdened with debt, struggling to save, or simply want to manage finances better – Estate is here to help!

Frequently asked questions (FAQ)

Personal Financial Coaching is a process where a professional coach provides guidance and support to help individuals or families improve their financial situation. It focuses on setting and achieving financial goals, managing money effectively, and making informed financial decisions.

Personal Financial Coaching can help you gain clarity and control over your finances, develop effective budgeting and saving strategies, reduce debt, and plan for retirement. It provides personalised guidance and accountability to help you create positive changes and build a secure financial future.

Yes, Personal Financial Coaching is suitable for individuals from all walks of life. Whether you’re just starting your financial journey, struggling with debt, or looking to maximise your wealth, our financial coaching can provide valuable insights, strategies, and support to help you achieve your goals.

While financial planning focuses on creating a roadmap for your goals and typically involves investment strategies, Personal Financial Coaching takes a holistic approach. It focuses on behaviour change, building financial skills, and adjusting mindset and habits for long-term financial success. On the other hand, financial counselling involves assisting individuals in overcoming specific financial crises.

The right financial coach should have relevant qualifications, experience, a suitable approach, and specialisation areas that meet your needs. Look for certified financial coaches, read client testimonials or reviews, and consider scheduling a consultation or free trial session to gauge their compatibility with your needs and goals.