Stress has become a familiar companion in the hustle and bustle of the modern world. Amidst the numerous sources of anxiety, financial concerns have emerged as a potent force that plagues employees across Australia. 48% of Australia‘s workforce worries about their finances, with more than one-third saying their financial situation is a significant cause of stress.

Financial stress silently infiltrates every aspect of an employee’s life, impairing their mental wellbeing and compromising their ability to personally and professionally thrive. From mounting debts to unanticipated expenses, the burdens of financial strain intensify, leading to a cascade of psychological distress. As the stakes grow higher, so does the toll it takes on individuals and their workplaces. According to a study, 57% of people worldwide say that financial stress is the primary cause of stress.

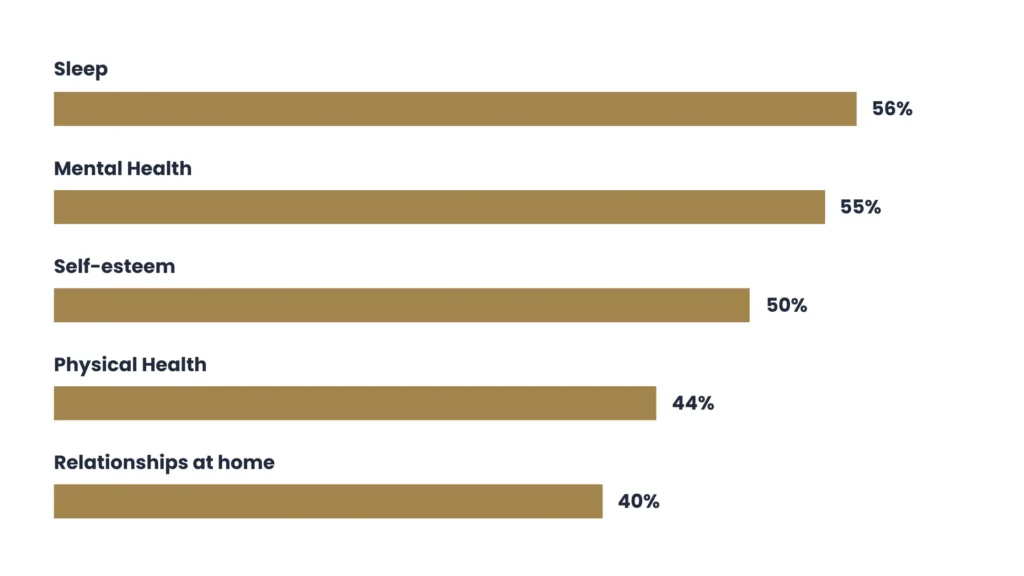

Financial stress affects every aspect of life, as shown below:

The numbers above underscore the alarming financial stress on the workforce worldwide. This blog delves into the profound impact of financial stress on Australian employees, shedding light on its psychosocial risks.

Join us as we unmask the true impact of financial stress, aiming to empower employees and employers alike to tackle this silent menace.

What Causes Employee Financial Stress In Australia?

Several factors contribute to employee financial stress within the Australian workforce. These causes and signs of employee financial stress can vary based on individual circumstances, economic conditions, and personal financial choices.

Here are some common factors that contribute to financial stress in the Australian workforce:

- High Cost of Living: Australia has a relatively high cost of living, particularly in major cities like Sydney and Melbourne. Housing, utilities, healthcare, education, and transportation expenses consume a significant portion of individuals’ income, making it challenging to meet financial obligations. In January 2022, 37.4 percent of Australians thought price rises were a big problem. This increased to 56.9 percent in October 2022. (Source)

- Wage Stagnation: Many employees experience limited salary increases that do not keep pace with the rising cost of living. This wage stagnation makes it difficult for individuals to keep up with expenses and lead to financial strain.

- Debt Burden: High levels of debt, combined with interest payments, create financial pressure and make it challenging to manage monthly expenses and save for the future. 50% of Australians feel financially stressed as a result of their household debt, with almost 85% saying it impacts negatively on their wellbeing. (Source)

- Inadequate Savings: Insufficient savings or lack of an emergency fund leave individuals vulnerable to unexpected financial challenges, such as medical expenses, car repairs, or job loss. Without a financial safety net, employees may experience heightened anxiety and stress when faced with unforeseen circumstances.

- Job Insecurity: The changing nature of work, technological advancements, and economic fluctuations have resulted in increased job insecurity. Employees worry about the stability of their employment, fear potential job loss, or face uncertainties related to contract work or gig economy positions.

- Inadequate Financial Literacy: A lack of financial knowledge and skills contribute to poor financial decision-making and employee financial stress. Limited understanding of budgeting, saving, investing, and debt management lead to financial missteps, creating a cycle of stress and financial difficulties.

- Unexpected Life Events: Life events such as divorce, illness, disability, or the loss of a loved one create significant financial challenges.

A range of resources from the Australian Institute of Family Studies show divorce has a serious impact on the finances of each former spouse, even if shared assets are split relatively evenly. (Source) - Financial Dependents: Supporting dependents, such as children, ageing parents, or family members with disabilities, place additional financial strain on individuals.

- Economic Factors: Broader economic factors, such as recessions, economic downturns, or industry-specific challenges, impact job security, income stability, and overall financial wellbeing.

What Makes Employee Financial Stress One Of the Biggest Psychosocial Risks For The Australian Workforce?

Employee financial stress has intensified across all income levels, with certain groups experiencing higher levels of stress. This includes women, single parents aged 30-44, and part-time workers. The percentage of women facing severe or moderate financial stress has risen from 19% in 2020 to 27%. For single parents in the 30-44 age range, the figure has increased from 13% to 25%. Similarly, part-time workers have seen a rise from 18% to 26% in the proportion facing financial stress. (Source)

Here’s why financial stress is a significant psychosocial risk at work:

- Mental Health Implications: The constant worry, fear, and uncertainty surrounding financial obligations and stability significantly impact an individual’s wellbeing. This, in turn, affects their ability to focus, make decisions, and perform effectively in their job roles.

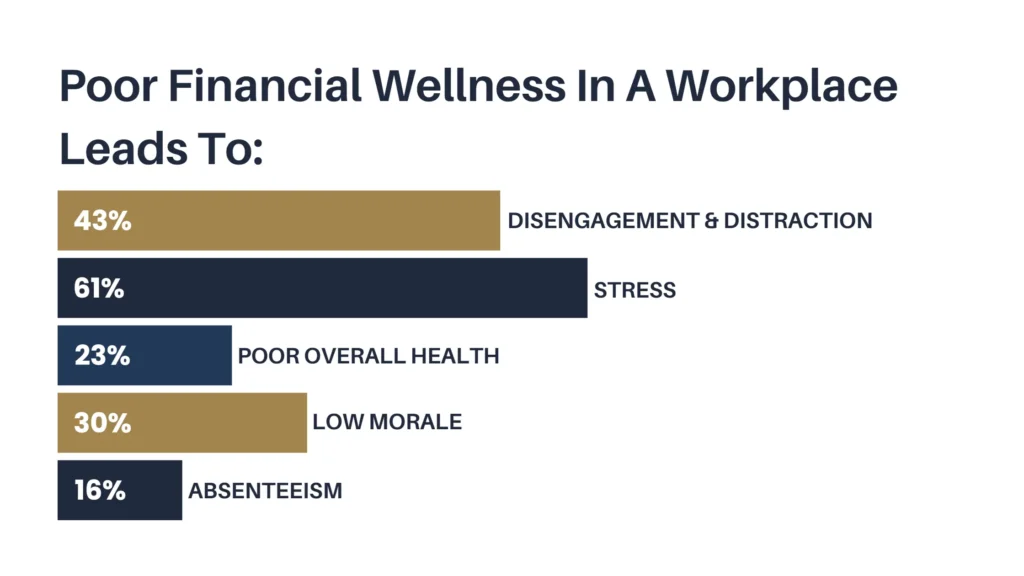

- Decreased Productivity and Performance: There is a deep relation between financial stress and employee performance. Employee financial stress impairs cognitive functioning and productivity in the workplace. Employees burdened with financial concerns may struggle to concentrate, experience reduced motivation, and have difficulty meeting deadlines.

Financial stress costs the economy $67 billion in lost productivity annually.(Source) - Increased Absenteeism and Presenteeism: Financial stress often results in higher rates of absenteeism, where employees may take time off work due to stress-related illnesses or the need to address their financial challenges.

Additionally, presenteeism becomes prevalent when employees are physically present but mentally and emotionally disengaged.

Financial stress affects productivity, with 21% of employees reporting reduced productivity due to financial concerns, nearly double the 2020 figure. It results in approximately 12 lost work hours per week due to “presenteeism.” Younger Australians, especially those under 30, are particularly distracted by their financial situation at work. (Source) - Workplace Relationships and Morale: Financial stress strains relationships among coworkers and between employees and their managers. Increased stress levels contribute to a negative work environment, leading to conflicts, tension, and decreased morale. It also hinders teamwork and collaboration, as employees struggle to effectively communicate and cooperate with colleagues due to the psychological burden they carry.

- Health and wellbeing: Financial stress has physical health consequences, as it often leads to heightened levels of stress hormones, disrupted sleep patterns, and unhealthy coping mechanisms such as excessive drinking or poor eating habits. These factors contribute to a decline in overall health and wellbeing, leading to increased healthcare costs and potential long-term health issues for employees.

- Work-Life Imbalance: Financial stress spills over into employees’ personal lives, causing work-life imbalance. The pressure to manage financial obligations results in employees working longer hours, taking on additional jobs, or sacrificing personal time.

- Organisational Impact: The cumulative effect of financial stress on employees leads to decreased morale, increased turnover rates, higher recruitment and training costs, and a decline in overall organisational productivity and performance.

Recognizing and addressing financial stress as a significant psychosocial risk is crucial for employers. By implementing supportive programs, fostering a positive work culture, and providing resources for financial education and assistance, organisations mitigate the negative impact of financial stress, enhance employee wellbeing, and create a more productive work environment.

Reducing Psychosocial Risk of Employee Financial Stress in Australia

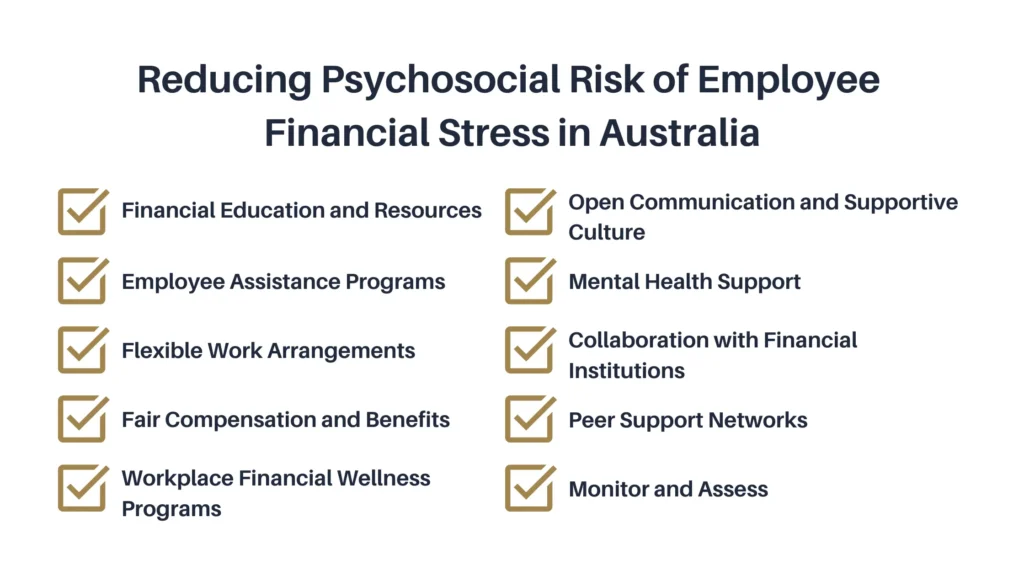

Reducing the psychosocial risk of employee financial stress in Australia requires a comprehensive approach that addresses both individual and organisational levels. Here are some strategies that help alleviate financial stress and promote employee wellbeing:

- Financial Education and Resources: Offer financial literacy programs, workshops, or online resources to help employees enhance their financial knowledge and skills. Provide access to reputable financial resources and tools that employees can use to make informed financial decisions.

Most employers agree that helping employees develop their financial literacy is incredibly valuable as the impact of poor financial wellness in the workplace is costly. (Source) - Employee Assistance Programs (EAPs): EAPs offer professional assistance in managing financial challenges, providing guidance on debt management, budgeting, and financial planning. EAPs also offer mental health support, which is crucial for individuals dealing with the emotional impact of financial stress.

- Flexible Work Arrangements: Consider offering flexible work arrangements, such as remote work options, flexible hours, or compressed workweeks. Flexibility helps employees better manage their personal finances by reducing commuting costs, providing a better work-life balance, and allowing time for addressing financial matters.

- Fair Compensation and Benefits: Regularly review and ensure that employees receive fair and competitive compensation packages that align with the cost of living. Consider offering additional benefits such as retirement plans, healthcare coverage, and access to financial advisors or financial wellness programs.

- Workplace Financial Wellness Programs: Establish financial wellness programs to reduce employee financial stress within the workplace. These programs can include seminars, workshops, or webinars on topics such as budgeting, debt management, financial goal-setting, and investment strategies. Consider partnering with financial experts or organisations to provide specialised support.

- Open Communication and Supportive Culture: Encourage managers and supervisors to be empathetic and supportive, providing a safe space for employees to seek guidance or express their challenges. Foster a supportive work environment that promotes employee wellbeing and emphasises work-life balance.

- Mental Health Support: Recognize the connection between financial stress and mental health and provide access to mental health resources. This can include employee assistance programs, mental health counselling, or partnerships with mental health organisations. Encourage employees to seek professional help when needed and reduce the stigma associated with mental health concerns.

- Collaboration with Financial Institutions: Collaborate with financial institutions to provide employees with access to financial products and services that promote financial wellbeing. This can include special rates on savings accounts, educational workshops, or financial planning sessions with experts.

- Peer Support Networks: Encourage the formation of peer support networks where employees can share experiences, exchange financial tips, and support one another. This creates a sense of community and solidarity, reducing the isolation often associated with financial stress.

- Monitor and Assess: Regularly assess and monitor the impact of implemented strategies on reducing financial stress in the workforce. Seek feedback from employees through surveys or focus groups to understand their needs better and make adjustments accordingly.

By implementing these strategies, organisations demonstrate their commitment to employee wellbeing, reducing employee financial stress, and creating a more supportive and productive work environment in the Australian workforce.

In conclusion, financial wellbeing is one of the most important aspects of general wellbeing (Source). It encompasses meeting basic needs, reducing stress, and providing security. When individuals are financially stable, they can pursue personal growth, cultivate meaningful relationships, and plan for the future. Individuals can work towards a more balanced and fulfilling existence by prioritising financial stability alongside other aspects of life.

Take control of your financial future with Estate App. Managing personal finances can be overwhelming, especially without proper education. That’s why we’re here to empower you with the knowledge and tools you need to succeed.

Discover the power of financial literacy at your fingertips. Estate App provides a seamless experience for learning and managing your finances, regardless of your background or previous education. Gain the confidence to make informed decisions and navigate the complexities of the real world.

Join the growing community of individuals taking charge of their financial wellbeing. Start your journey towards financial empowerment. Contact us today!

FAQs

Financial stress can have a negative impact on employees in several ways. It can lead to decreased productivity, increased absenteeism, and health problems. Employees may also experience job dissatisfaction, strained relationships, and reduced problem-solving abilities. Addressing financial stress through support programs and resources can help improve employee wellbeing and performance.

To deal with financial stress in the workplace, you can:

- Provide financial education and resources.

- Offer employee assistance programs for counselling and support.

- Consider flexible work arrangements.

- Implement financial wellness programs.

- Foster open communication and support.

- Offer competitive employee benefits and incentives.

- Provide referral resources to external financial assistance.

Yes, financial concerns can make workers less productive due to increased distraction, stress, absenteeism, lack of motivation, and time spent on personal financial matters during work hours.

Financial challenges for employees include low wages, debt burden, insufficient savings, lack of financial literacy, healthcare costs, unplanned life events, retirement planning challenges, tax obligations, cost of living increases, and financial emergencies.